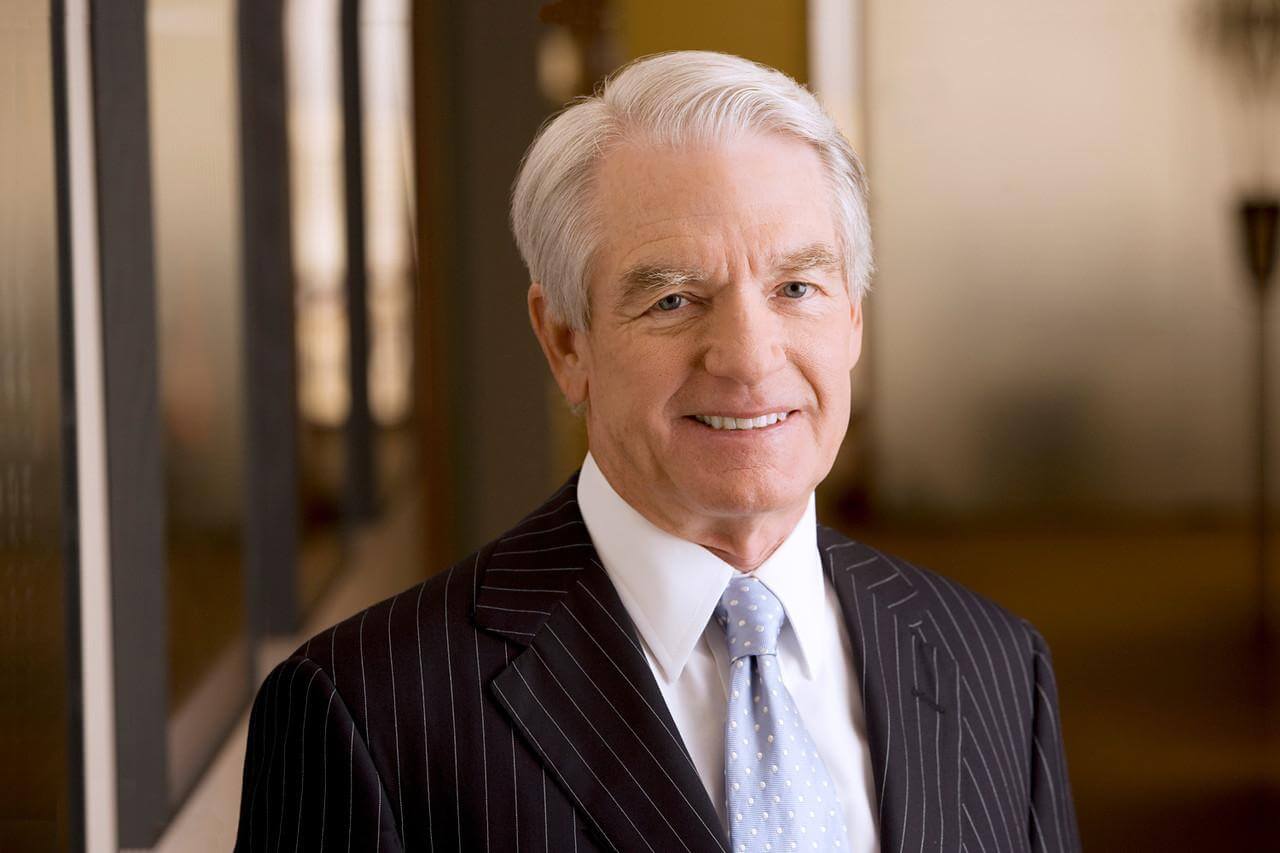

In the ever-evolving landscape of finance, few names resonate as strongly as Charles Schwab. Founded by Charles R. Schwab in 1971, the company has transformed the way individuals engage with their finances. From its humble beginnings as a traditional brokerage firm to its current status as a leading financial services provider, the Charles Schwab success story is a testament to innovation, adaptability, and a commitment to empowering investors technewztop.

Early Years and Vision

Charles Schwab’s journey began with a vision to democratize investing. Born in 1937 in Sacramento, California, Schwab displayed an entrepreneurial spirit from a young age. In the early 1970s, the financial industry was dominated by high fees and limited access, making it challenging for the average investor to participate in the market. Schwab saw an opportunity to change this paradigm by offering discounted commissions and providing easy access to investment tools and resources nasik fatafat.

Disruption in the Brokerage Industry

One of the key milestones in the Charles Schwab success story was its disruptive impact on the brokerage industry. By eliminating the need for traditional brick-and-mortar offices and leveraging technology to streamline operations, Schwab was able to significantly reduce costs and pass those savings onto customers. This approach democratized investing, allowing individuals of all backgrounds to build wealth through the stock market.

Embracing Technological Innovation

A defining characteristic of the Charles Schwab success story is its relentless pursuit of technological innovation. From pioneering online trading platforms to embracing robo-advisors and mobile apps, Schwab has consistently stayed ahead of the curve in leveraging technology to enhance the customer experience. By providing intuitive tools and educational resources, Schwab empowers investors to make informed decisions and take control of their financial futures.

Expansion and Diversification

As the company grew, so too did its range of services. Charles Schwab expanded beyond traditional brokerage services to offer a comprehensive suite of financial products, including retirement accounts, banking services, and investment advice. This diversification not only broadened Schwab’s customer base but also positioned the company as a one-stop destination for all things finance.

Commitment to Customer Service

Central to the Charles Schwab success story is its unwavering commitment to customer service. Schwab understands that investing can be complex and intimidating for many individuals, which is why it places a premium on providing personalized support and guidance. Whether through online chat, phone support, or in-person consultations, Schwab’s team of experts is dedicated to helping clients navigate the intricacies of the financial markets.

Adapting to Changing Trends

The financial industry is constantly evolving, with new trends and technologies reshaping the landscape. Throughout its history, Charles Schwab has demonstrated a remarkable ability to adapt to these changes. Whether it’s the rise of passive investing, the emergence of cryptocurrency, or the growing importance of sustainable investing, Schwab has consistently evolved its offerings to meet the needs of today’s investors isaimini vip.