In today’s fast-paced business environment, automation has become a game-changer in various industries, and bookkeeping is no exception. With the advancements in technology, traditional manual bookkeeping methods are being replaced by automated systems that streamline processes and increase efficiency.

Bookkeeping and the AP/AR process are crucial aspects of financial management for any organization. Traditionally, these tasks were performed manually, requiring significant time and effort.

In this article, we will explore how automated solutions transform the way businesses manage their financial records through bookkeeping and the AP/AR automation process.

Role of Automation in Bookkeeping

Automation plays a pivotal role in transforming bookkeeping by simplifying and expediting various tasks. Let’s explore some key areas where automation is making a difference.

1. Streamlining Data Entry

Manual data entry is not only time-consuming but also prone to errors. Automated systems leverage technologies such as optical character recognition (OCR) to extract data from invoices, receipts, and other financial documents. This eliminates the need for manual entry, reducing the chances of errors and increasing productivity.

2. Improving Accuracy

Automation minimizes the risk of human error inherent in manual bookkeeping. By automating calculations and data synchronization, businesses can ensure accuracy in financial records, reducing the chances of discrepancies and ensuring compliance with regulatory requirements.

3. Enhancing Efficiency

Automated bookkeeping systems enable faster processing of financial transactions. Tasks that previously required hours or even days can now be completed within minutes. This increased efficiency allows businesses to allocate their resources to more value-added activities, such as financial analysis and strategy development.

Benefits of Automation in Bookkeeping

The adoption of automation in bookkeeping and the AP/AR process brings several advantages to businesses. Let’s delve into some of these benefits.

1. Time and Cost Savings

Automation significantly reduces the time and effort required for bookkeeping tasks. By automating repetitive and time-consuming processes, businesses can allocate their resources to more strategic activities. Additionally, automation reduces the need for manual data entry, resulting in cost savings by minimizing labor requirements.

2. Reduced Errors and Fraud Risks

Manual bookkeeping processes are susceptible to errors and fraud. Automation mitigates these risks by enforcing standardized processes, reducing human intervention, and implementing robust internal controls. This helps businesses maintain accurate financial records and enhances their ability to detect and prevent fraudulent activities.

3. Real-Time Reporting and Insights

Automation enables real-time tracking and reporting of financial data. With up-to-date information readily available, businesses can make informed decisions promptly. Real-time insights into cash flow, revenue, and expenses empower organizations to identify trends, optimize resource allocation, and improve financial performance.

Automation in Accounts Payable Process

The accounts payable process involves managing and processing invoices, tracking payments, and maintaining vendor relationships. Automation revolutionizes this process, bringing numerous benefits to businesses.

1. Invoice Processing and Approval

Automated systems streamline the invoice processing workflow, from receipt to approval. Optical character recognition (OCR) technology extracts data from invoices, reducing the need for manual data entry. Automated approval workflows and electronic routing enable faster invoice processing, reducing delays and optimizing cash flow management.

1. Payment Automation

Automation facilitates seamless payment processing by integrating with banking systems and electronic payment gateways. Businesses can set up automated payment schedules and initiate payments with just a few clicks. This not only saves time but also ensures timely payments, avoiding late fees and maintaining good vendor relationships.

1. Vendor Management

Automated systems provide a centralized platform for managing vendor information. Businesses can store and access vendor data, track payment histories, and monitor outstanding balances. This streamlines vendor management, enabling businesses to negotiate favorable terms, resolve disputes efficiently, and build stronger partnerships.

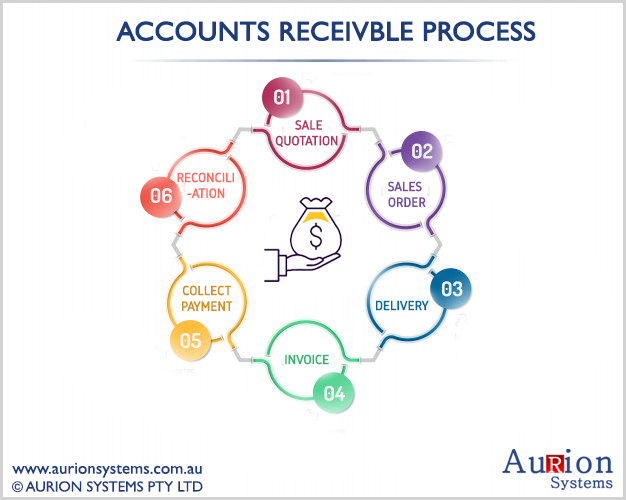

Automation in Accounts Receivable Process

The accounts receivable process involves issuing invoices, tracking customer payments, and managing cash flow. Automation brings significant improvements to this process, enhancing efficiency and optimizing revenue collection.

1. Automated Invoicing

Automated systems enable businesses to generate and send invoices automatically. Customizable invoice templates, integrated with customer data, reduce manual effort and ensure consistency. Automated invoicing also includes features like invoice numbering, due date calculation, and automatic tax calculations, simplifying the process for businesses.

2. Payment Reminders and Collections

Automation helps streamline the payment follow-up process by sending automated payment reminders to customers. Integrated payment portals enable customers to make payments conveniently. In the case of overdue payments, automated collection processes can be initiated, improving cash flow and reducing bad debt.

3. Cash Flow Management

Automated systems provide real-time visibility into cash flow by tracking customer payments and outstanding invoices. Businesses can eliminate mistakes in cash flow forecasts, identify potential bottlenecks, and take proactive measures to optimize working capital. This enables better financial planning and ensures smooth operations.

Conclusion

Automation is revolutionizing the way businesses approach bookkeeping and the AP/AR process. By streamlining data entry, improving accuracy, enhancing efficiency, and providing real-time insights, automation brings significant benefits to organizations. Embracing automation empowers businesses to optimize resource allocation, reduce errors and fraud risks, improve cash flow management, and make informed financial decisions.

As a trusted partner with a track record of excellence and expertise, IBN Tech offers comprehensive and customized bookkeeping solutions in the USA that align with your business objectives. Schedule a free consultation with them to learn more about their services and pave the way for growth.